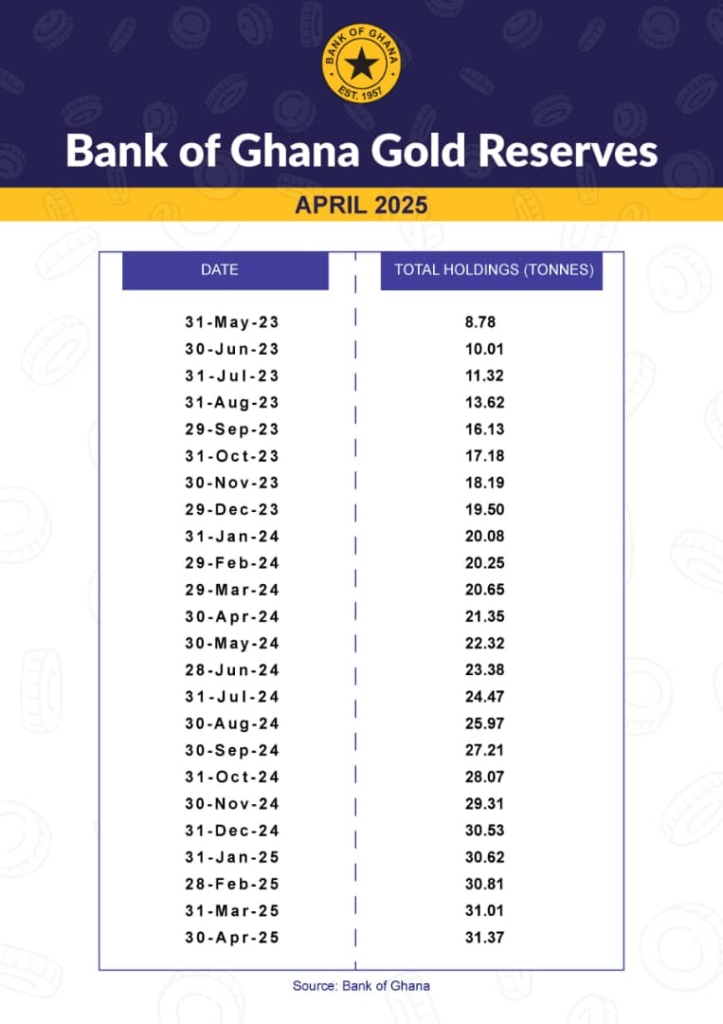

The Bank of Ghana (BoG) has announced that its total gold reserves hit 31.37 tonnes by the end of April 2025. This figure reflects a remarkable increase of over 200% compared to December 2022.

According to BoG’s market data released on April 5, 2025, the reserve growth underscores the success of the bank’s Domestic Gold Purchase Programme, launched in June 2021. This initiative was designed to diversify Ghana’s reserve assets and reduce exposure to global dollar volatility.

Back on March 31, 2023, the BoG held just 8.78 tonnes of gold. However, consistent monthly additions have significantly boosted reserves, peaking at 31.37 tonnes. Notably, in some months, gold holdings increased by more than 20%. Although the pace of accumulation has slowed slightly in 2025, the overall trend remains strong.

How the BoG Built Up Reserves

Under the Domestic Gold Purchase Programme, the central bank buys gold directly from local mining companies and pays in Ghana cedis. This strategy helps insulate Ghana’s economy from global financial shocks while strengthening its currency reserves.

In past years, the BoG had voiced concerns over the country’s low gold reserves. But Governor Dr. Johnson Asiama recently reaffirmed the central bank’s commitment to building international reserves. “This move should go a long way in stabilizing the cedi,” he told JOYBUSINESS.

What This Means for the Cedi and Market Stability

A stronger gold reserve position places the BoG in a better spot to defend the Ghanaian cedi. It also boosts investor confidence in the bank’s ability to manage external pressures.

Previously, low gold reserves raised doubts about the BoG’s strength, fueling speculation and currency instability. Now, the substantial increase is expected to discourage such speculative behavior.

In summary, BoG’s growing gold reserves serve as both a financial shield and a strategic tool to bolster the local economy.